上週五,歐美股市下跌2%, 原因是說中國經濟放緩,炒家為什麼不說歐美經濟放緩呢?因為歐美經濟,會受中國影響。

中國影響全世界,中國已經是強國。30年前鄧小平推行改革開放,中國市場只是半開放,中國經濟巳能突飛猛進。

習近平現在推行自由貿易區,中國市場將進入更開放時代。中國經濟會再出現奇蹟。

歐美股市巳升至歷史新高,急跌是必然的。任何東西的價格,不可能屢創新高而不下跌的。

香港股市衍生工具世界排第一,是大賭場。成交額大的股票都被利用來作道具,因此會大幅波動。

有實力的投資者,可以不為所動。目前應該耐心等待,捕捉機遇。

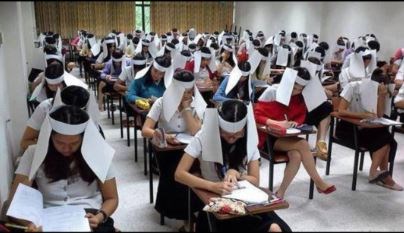

泰國大學生,考試偷看別人试卷。校長要全体扣帽子。

香港股票是世界上最便宜的。她已在偷偷地蓄勢待發。

我們现在應該偷偷地買入股票,偷偷地炒短線。不要錯過機會。

我昨天參觀 深圳前海,自由貿易區,眼前一片靜靜的黃土地,等着主人來。

中國,人多、地多、錢多、繁榮安定。投資者只要有信心,加上耐性, 必有所成。

前海自貿區 股票,值得投資。

遇事忍耐是中國人的崇高品質。

古人說︰「忍人之所不能忍,才能為人所不能為。」

現今科技追求速度,人的 忍耐性格 也漸失傳。投資者持有股票已沒 耐性,因此 牛熊證、期指、認股證等,應運而生,大行其道。

世上成功投資人士,都在逆境中入市,然後忍,他們通過「忍」達到目的。

今天介紹︰ 股市會向上冲過恒指二萬三千

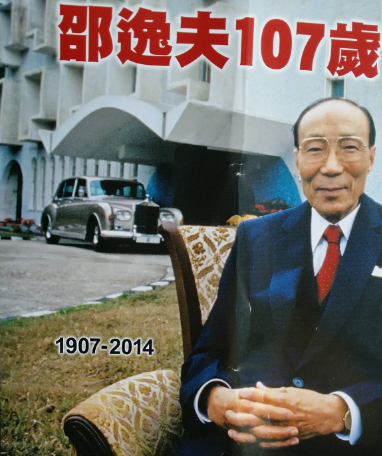

我和邵逸夫第一次见面,是30年前。我有一座兴建中的戲院准備出售,我朋友是方逸華的親戚,于是联系上了邵逸夫。他约我午膳。在西贡邵氏片埸辦公室內的飯廳,席上有方逸華。邵逸夫風度翩翩,健談,見識豐富,帶着微笑,坐得筆直。他告訴我们气功的好處。他說只是吃便飯。桌上是蒸石班鱼,清炒菜心,毛豆,豆腐。很清淡。他說厨師是上海女人,已經跟了他20多年。方逸華很少說話。飯桌上,大家都沒有談生意。飯後,他送到我們出大門,说他的秘書會聯繫我。

第二天,他的秘書電話聯繫我。原來是男秘書,會計師學歷,負責訂合約。後來我们成为好朋友。通過這位男秘書,我常出入邵氏片場。

我第二次和邵逸夫見面是在晚上,尖東某酒店地庫的一間酒樓。见面他立即谈戲院的設計有所修改,他說他巳有二百間戲院。談完设計和修改费用後,入席。席上他不談生意,只談大家感興趣的生活趣事。

我第三次见邵逸夫,是戲院交易完成後。是晚上,慶祝順利成交,這次晚飯有雞吃。他表示感謝賣戲院给他。方逸華在場,很少說話,十分尊敬邵逸夫。

我和邵逸夫做生意的過程,我有所啟發。邵逸夫做生意,是三部曲 : -----

第一步 : 午膳見面,先成為朋友,不談生意。

第二步 : 晚飯,公平交易。

第三步 : 晚飯。感謝完成交易。令人覺得他有人情味。

邵逸夫做生意三部曲方式,對我日後營商,很有幫助。

再見,邵逸夫先生。我懷念你。

( 徐潤民 , 寫于 2014-1-10 深晚, 香港 )

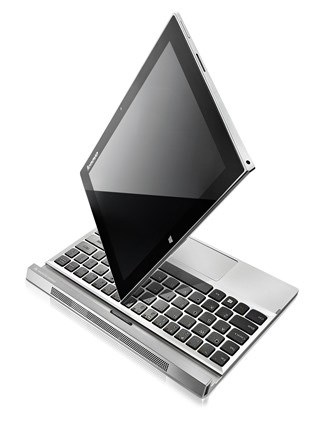

新年将到, 送什麼禮物呢? 送平板電腦吧 !

這星期大量的 Windows视窗平板湧現,勢將成為最熱賣的產品。萍果 巳落後了。

视窗Windows 平板等於桌上電腦,上網也可以用 Java 和 Flash,上網炒股一流。

其中 Lenovo联想的新Lenovo Miix 2 , 11” 平板($699美元) 卻有著 Microsoft Surface Pro 2 ($899美元) 相同的配置, 联想平板抵買 !

長假期很多人也喜歡外遊,我也很想去歐洲澳洲,奈何家裡多了個小人兒,不方便遠遊,於是便去了長洲。

到達後發現那裏無論大街小巷都擠滿遊人,感覺就如置身旺角一樣,跟印象中寧靜的長洲格格不入。

行得有點餓,打算買長洲魚蛋吃,發現最好吃那一檔排了長長一條人龍,其他檔口人龍也不短,頓時餓意全消,趕船回家去了。

結婚初期,時間和金錢花在自己身上。生了孩子後,時間和金錢,都貢獻給孩子了。

香港股市是健康的,旅遊股 值得投資。

By Carmen Wong